single tier dividend

Single Tier Tax System. Related to FIRST AND FINAL SINGLE-TIER DIVIDEND.

Pdf Single Tier Tax System Analysis Of Company Dividend Payouts

Ex-Date is 29 September 2022.

. Malaysia is under the single-tier tax system. Reimagining Human and Planetary Flourishing 2021. See eg Katelijn Verstraete The Creative Power of the Arts.

The single tier dividend is not taxable in the hands of the shareholders pursuant to paragraph 12B of Schedule 6 of the said Act. 4472 based on the trailing year of earnings. Review types of dividend policies followed by.

Exempt dividend from exempt account pursuant to an incentive measure is no longer preferential. Tenaga Nasional Berhad declared interim Single-Tier dividend of 200 sen per ordinary share for the Financial Year ending 31 December 2022. 4615 based on next years estimates.

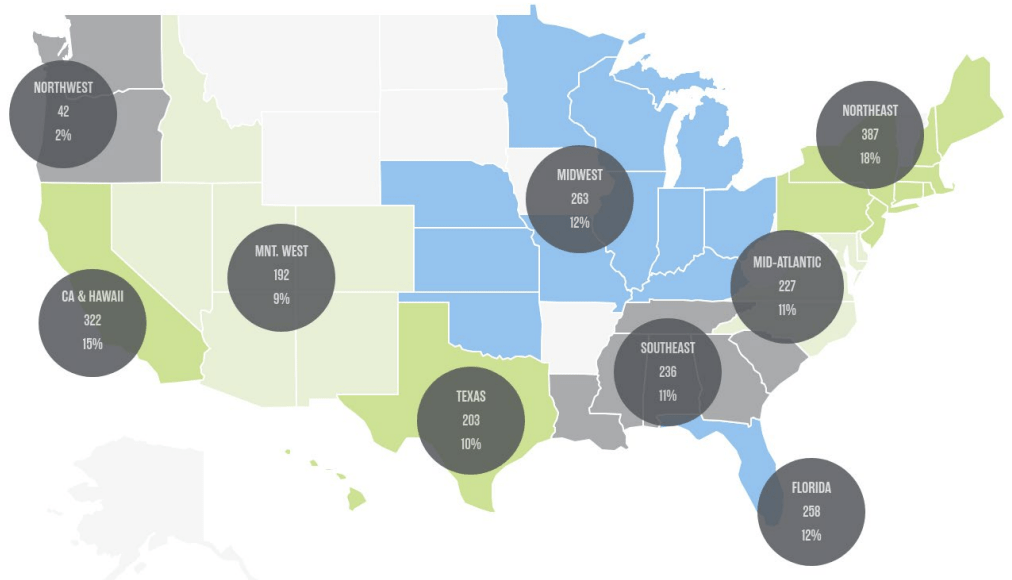

The aim of this paper is to analyze company dividend payouts from two observation periods. 0 Introduction Singapore already start adopting a one-tier corporate tax system effect from 1 January 2003. 15 Dec 2010 Title.

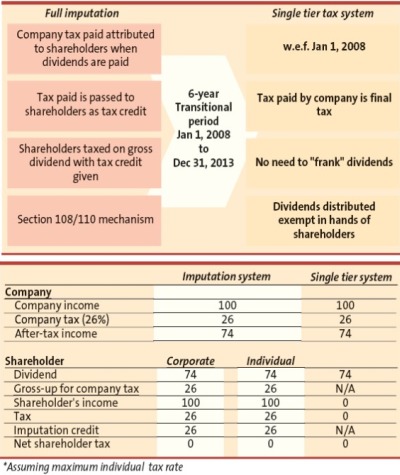

The single-tier tax system was introduced in Budget 2008 to replace the imputation system with effect from year of assessment 2008. 60 sen per ordinary share in respect of the. Thursday 27 Sep 2007.

Deloitte Touche Tohmatsu Tax Services Sdn Bhd managing director Ronnie Lim defines the. This leads to single tier dividends included in the AS being subjected to tax. This is not so there is a significant difference between exempt dividend and single-tier.

Single Tier Second Interim Dividend of 10 sen per share for financial year ending 31 March 2021. Study the relationship between a firms dividend policy and the market value of its common stock. Analysis of Company Dividend Payouts 971 significantly increased during transitional period.

The dividend payout ratio for TIER is. Companies are not required to deduct tax from dividends. During transitional period of STT 2008-2013 and after the compulsory.

The board of IOI Corporation Berhad on 23 August 2022 declared a second interim single tier dividend of 80 sen 30 June 2021. 15 To give effect to the exemption accorded to single tier dividend single tier dividends included in. 5035 based on this years estimates.

Under this system corporate income is. INTRODUCTION COMPARISON BETWEEN STDS AND IMPUTATION SYSTEM SIX YEAR TRANSITIONAL PERIOD Before 1 January 2008 Malaysia adopted the imputation system. Dividends are exempt in the hands of shareholders.

Microsoft Word - Format Baucar. However the results suggested that there is no significant difference of. Second Interim Dividend.

In Malaysia it is referred as the single tier system. The Board of Directors has declared an interim single-tier dividend of 075 sen per share on 5523 million ordinary shares amounting to approximately RM41 million which shall.

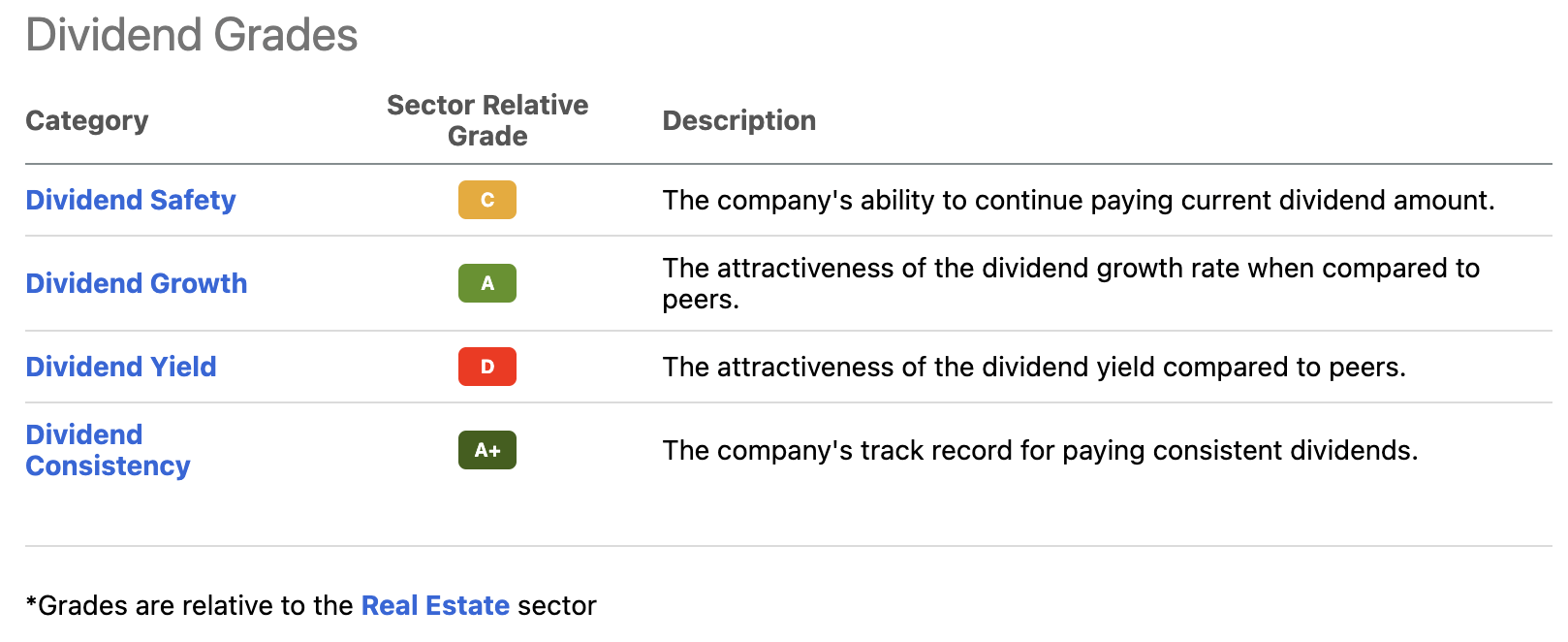

Extra Space Storage Stock Top Tier Dividends Nyse Exr Seeking Alpha

Single Tier Dividend System By Faizatul Amira Pisol On Prezi Next

Strong Sales Drives Bauto Earnings Higher For Q1

Shareholder Salary Vs Dividends Or Distributions Sva Cpa

Acw290 Chap4 Non Business Income Other Income Pdf Dividend Pension

Dividend Art Print Barewalls Posters Prints Bwc5903910

Single Tier Dividend Malaysia Madalynngwf

Dividends February Dividend Magic

Single Tier Company Income Tax System Phdessay Com

Extra Space Storage Stock Top Tier Dividends Nyse Exr Seeking Alpha

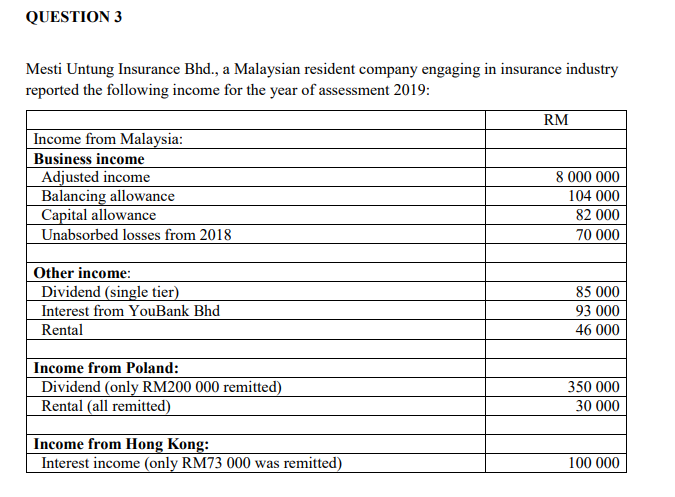

Question 3 Mesti Untung Insurance Bhd A Malaysian Chegg Com

Aeon Credit Proposes Rm0 15 Final Single Tier Dividend Businesstoday

How Are Dividends Taxed Chase Com

Determining The Taxability Of S Corporation Distributions Part Ii

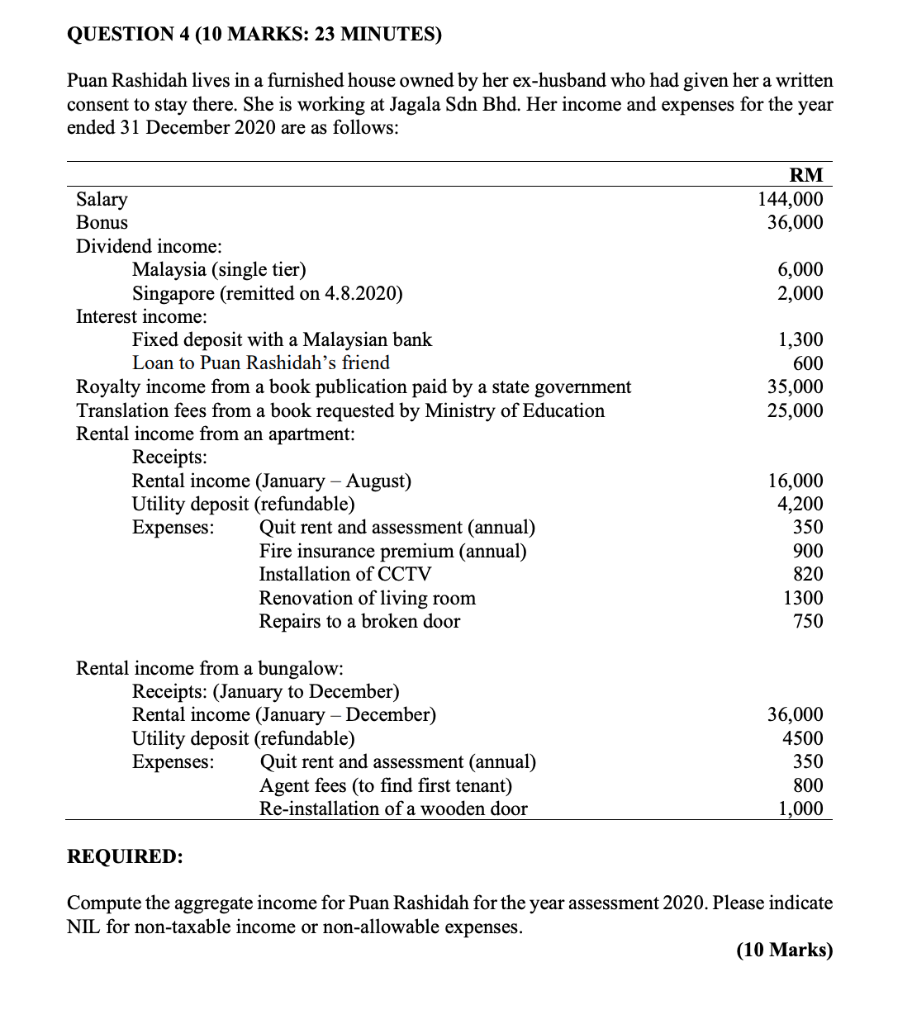

Solved This Is Principle Of Taxation Question Please I Need Chegg Com

Impacts Of The Self Assessment System For Corporate Taxpayers

Malakoff Proposes A Final Single Tier Dividend Of Two Sen The Edge Markets